Akil Balachandran is working to reshape the financial advisory landscape with BlueMind, a specialized platform for financial and insurance advisors. BlueMind offers an AI-driven automated compliance platform that streamlines advisors' workflows as they work with clients.

Balachandran moved to Canada in 2002 as a medical student. He says he became increasingly attracted to the finance world, so he switched programs. During his final year in the university, Balachandran began his career as a financial advisor with Sun Life. Balachandran says his time as a finance advisor showed him how unnecessarily complicated the finance and insurance industries could be for advisors and their clients.

In 2018, Balachandran took a leap of faith, leaving his secure corporate position to start his firm, Life Plan Investments. He says he saw how consumer behavior and the finance industry had changed and wanted to develop solutions to help people make better decisions.

“If I'm a doctor, I can help only one person at a time. But if I build a hospital, I can help many people. So when I was building my firm, I asked the same thing—what can I do to help more people,” he says.

BlueMind delivers on this by providing a secure, all-in-one platform where advisors can store and manage their client data, ensuring compliance and reducing administrative burdens. Its platform makes it simple for advisors to securely store and manage client files to keep them compliant with financial industry and government regulations.

“Over 80% of financial advisors in the U.S. and Canada are independent. That’s 3.5 million insurance and financial advisors who are struggling with legacy tools that waste time and can create risk for client data. We solve that with our platform by generating workflows to ensure their clients’ files are secure and up to date,” he says.

BlueMind is more than just technology. Balachandran says the company understands the importance of maintaining the human element in financial advising.

“Technology is an enabler, but it’s not a solution in itself. People still need personal interaction and trust when it comes to their finances,” he says.

BlueMind is also developing a client-facing portal to allow consumers greater transparency in their financial plans and secure communication with their advisors. This feature is especially crucial as many financial advisors are nearing retirement age and looking to pass their businesses on to the next generation.

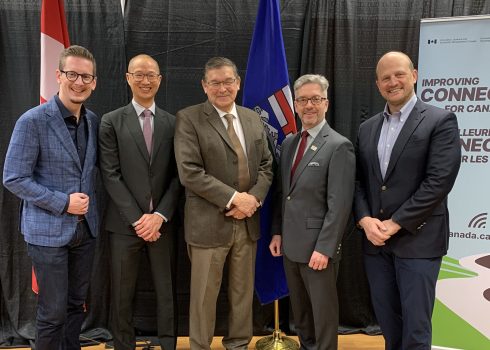

Markham has played an integral role in BlueMind’s growth. The city’s supportive tech ecosystem, including resources like YSpace, has been instrumental in helping the company scale.

“Markham has been a great place to build our business,” says Balachandran. “The city has provided us with opportunities to network with international investors and showcase our technology at events like Collision and StartupFest.”

For Balachandran, the journey has been one of constant learning and adaptation. His vision for BlueMind is not just to build a successful company but to create a global platform that revolutionizes the financial advisory industry.

“We want to tell a Canadian story, but we’re building for the world,” he says. With Balachandran at the helm, BlueMind is well on its way to becoming a leader in digital financial solutions.